Fine wine sales are expected to grow 6-10% in 2014. Last year’s west coast harvest (Washington, Oregon, California) was once again large – California is estimated at 3.94 million tons. And, at 850 million gallons, U.S. wine consumption is at a record high.

That’s the good news for many in the wine industry.

The not-so-good: gross profit margins of winery operations will take a hit this year, thanks to the high grape costs associated with the tricky 2012 vintage. And those Millennials you thought you had all figured out? They continue be a bit of a shifty lot. Their propensity to experiment with lesser known varietals, and seek out wines far from home could pose a challenge for domestic producers.

HAVE YOU GIVEN ANY THOUGHT TO YOUR FUTURE, SON?

That, and other extensive analysis and predictions were released today by Silicon Valley Bank in their annual “State of the Wine Industry” report. Those that have followed it year-on-year and our coverage on Stark Insider know it’s one of the most reliable, comprehensive and interesting reports. This year’s edition is 42-pages (free PDF download available at the SVB web site), and jam-packed full of insightful commentary and data covering just about everything under the (hot Napa) sun: grape supply (think abundance), consumer demand (improving), luxury markets (Boomers are your “cohort”), and the financial performance of wineries (margins under pressure).

OFTEN THE FUTURE LOOKS PRETTY MUCH LIKE GRASS GROWING…

BUT NOT THIS TIME

Rob McMillan, who leads the wine division at SVB and authored the report, notes that this year is different. “We believe we are trending to a transition point as Boomers hit retirement and the economic condition of the Millennials replacing them is burdened with high levels of student debt and weak job prospects,” he writes. ” The evolution from Boomers to Millennials as dominant purchasers of wine will prove a significant headwind to sustained growth in the wine business.”

KEY WINE TRENDS AND RELATED DATA POINTS 2013/2014

In 2014 look for increased M&A activity in the wine business, continued growth of the direct-to-consumer channel (i.e. sales via web sites) and, aside from the aforementioned luxury wine segment, expect prices for the most part to remain steady state.

— Merlot once again leads inventory of California bulk wine

— Three consecutive quarters of GDP growth bodes well for the overall economy

— Worldwide luxury goods spending will grow approximately 2% in 2014 – luxury cars, wine and spirits, and hotels will outpace that rate with growth expected to be 6%

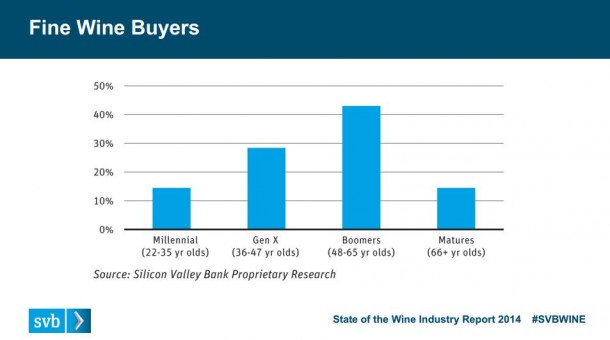

— Boomers (48-65 yr olds) lead fine wine buying purchases, accounting for over 40% of sales

— Pretax profits for wineries fell from 6.9% to 5.4% in 2013

CALIFORNIA: MEET WINE’S MOVERS AND SHAKERS

Get to know some of the faces and stories behind California wine. In this 5-part series, Stark Insider TV sits down and talk wine with some of the wine world’s most colorful characters. Each of the segments are linked below:

JEFF SMITH, Hourglass Vineyard

WHAT DOES IT ALL MEAN?

After reading through the 42-page report I came away with the same feelings I have about the overall economy and its recovery. That would be: cautiously optimistic (please don’t tell Rob McMillan at SVB I used that cliche).

The strength of the stock market over the past year or so should reflect well not only in improved consumer sentiment, but–perhaps more importantly–the ability for increased wine buying action (especially, as noted in the report, at the upper end of the wine market). Boomers are still the largest buying group of wine. Eventually, though, wineries will need to decode the ever-interesting group known as the Millennials. I don’t completely buy into the fact that the demographic is dramatically different from any that preceded it; younger generations always start with less disposable income (there’s just something about having 2-3 decades of earnings that results in older people having more net worth!) and they’re always faced with the prospects of finding employment, making ends meet, and, of course, finding a good deal on a used AMC Gremlin. Still, no one can question that today’s environment for wine is markedly different. Social media didn’t exist even a decade ago. Tablets have killed PCs. And we’re in the throws of a new start-up, innovation-oriented culture.

[Silicon Valley Bank: State of the Wine Industry Report]