Stocks might not be the only thing in for a rough ride in 2016.

A new report out of Silicon Valley Bank predicts a decline in U.S. per capita wine consumption after more than 20 years of consecutive growth.

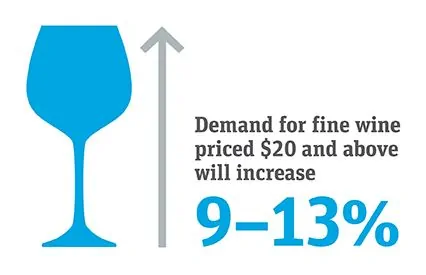

There is a bright spot, however, and you’ll find that at the top end. Demand for premium wine will increase (9-13% in 2016, down from 14-18% the previous year), notes Rob McMillan, author of the State of the Wine Industry Report, and founder of the wine division at SVB.

Baby Boomers are now beginning a slow decline in consumption.

“While demand for premium wine will increase this year, there are clouds on the horizon that should be considered. We believe total and per capita wine consumption in the U.S. will drop for the first time in more than 20 years due to emerging generational shifts in consumption patterns that we see accelerating in the near term,” he writes.

Further, aging baby boomers are being replaced by “frugal millennial consumers” — a trend that could spell trouble for mainstream wine sales, as millennials have “proven more agnostic” when it comes to choosing between beer, spirits or wines.

State of the Wine Industry Report

Additional findings and predictions for 2016:

- Sales of bottles above $10 will rise between 4% and 8%, while volume and prices will drop for bottles priced below $8

- Large and notable sales of premium vineyards and wineries, will drive an active M&A environment throughout the year

- Tens of thousands of additional grape acres will be permanently removed from the California Central Valley

- Supply of arable land suitable for higher-end wine production will narrow and drive vineyard prices higher

- The lowest price generic segment that appealed to the entry-level consumers of the 1960s has permanently lost its appeal

- The Gen X cohort will surpass the baby boomers around the year 2021 to become the largest fine wine consumer demographic in the U.S., and the millennial cohort will surpass the Gen X cohort around the year 2026

Source: State of the Wine Industry 2016, by Rob McMillan, Silicon Valley Bank

“While retail bottle prices will modestly increase this year, the consumer will still benefit from three consecutive large and excellent harvests in 2012, 2013, and 2014,” McMillan said. “Not all of that wine will make it into branded premium labels and that will leave plenty of great juice available for domestic négociants who will repurpose it into imaginative labels.”

2016 is shaping up to be an interesting year across multiple fronts. Though, I must wonder, if the stock market continues to bathe in volatility, would that not lead to a run on local wine shelves?