Problem? What problem?

Instead, let’s all agree to call it an opportunity. A “growth opportunity.”

That’s how the team at Silicon Valley Bank has framed one of the biggest challenges facing the wine industry.

And that is… millennials are simply not buying a lot of wine.

Hence, the opportunity for wineries to somehow crack the code, and ratchet up sales by successfully tapping into the younger demographic. However, that seems easier said than done.

Worse yet, the annual state of the wine industry report says there’s lots of product sitting across various distribution points and warehouses.

“Today, the wine supply chain is stuffed,” said Rob McMillan, founder of Silicon Valley Bank’s Wine Division and author of the report. “This oversupply, coupled with eroding consumer demand, can only lead to discounting of finished wine, bulk wine and grapes. US wine consumers will discover unprecedented retail value in 2020 and should buy up.”

Silicon Valley Bank

State of the Wine Industry Report

Highlights and predictions from the 2020 survey and report:

- Acute oversupply will lead to wide-spread discounting and present the US wine consumer with the best wine retail values in 20 years.

- The 2019 harvest will likely produce normal to slightly-below-normal yields in California, and below-normal yields in Oregon and Washington. The lower yields won’t help with the oversupply, however.

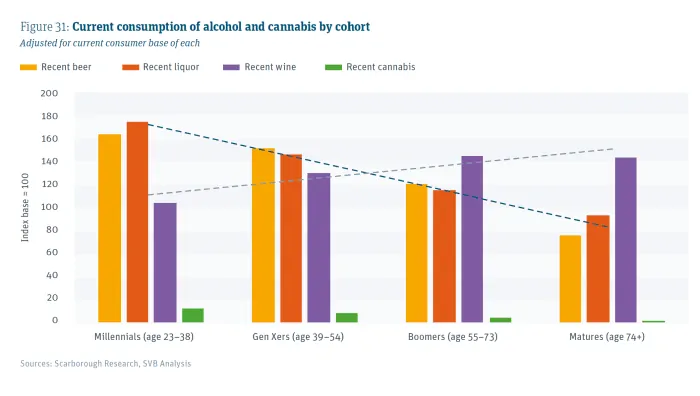

- The large millennial population hasn’t yet begun to embrace wine, presenting the wine industry with its largest growth opportunity.

- 71 percent of wineries reported 2019 was a good year, and 24 percent say it was their best year in history. At the same time, an increasing number of wineries are reporting poor financial results.

- Winery owners’ confidence in current market conditions dropped precipitously in 2019, with 49 percent of respondents taking a pessimistic view, compared to only one percent who were pessimistic in 2018.

- Oversupply with diminishing volume growth in demand will lead to vineyard removals and reduced returns for growers in most regions.

For consumers the good news is the potential for discounting. One way to move stagnating product is to cut prices. SVB says to expect that to happen in 2020. The result? Cheaper wine prices at retailers across the US.

On the flipside, the oversupply and overall weakening demand could “lead to vineyard removals and reduced returns for growers in most regions.”

That’s a scary proposition for producers; especially given the white hot economy and stock market. If buyers don’t buy wine when times are good, what about when economic conditions take a turn for the worse leading to household cuts in discretionary income?

Then there’s the vaunted millennial shopper. Given their penchant for craft beer, craft cocktails, and unique and personal experiences, how can a winery make its same-old Chardonnay or Cabernet Sauvignon seem hip and trendy? As is often the case asking questions seems easier than hunting for answers.

Meanwhile, DTC (direct-to-consumer) sales have stabilized at 60%. In broader terms that would suggest that 6 out of 10 bottles approximately are sold direct from a winery to a consumer. Here, no distributor is involved in the supply chain.

A wild card in my estimation in this space: Amazon.

I recently placed my first ever order for wine direct (i.e. not from a winery) via Amazon and its Whole Foods grocery delivery service. Here in the San Francisco Bay Area Amazon offers next day, two hour delivery windows. Pay a premium and you can even have your personal shopper deliver an order the same day. My order arrived right on time, and the wine bottles were in perfect condition as was the rest of my order. I’m not so sure I’d use online all-the-time for grocery and beverage orders (Costco and Trader Joe’s still offer strong in-person value propositions), but with the insanity that is Silicon Valley traffic it sure can be a time saver.

Like each instance before there’s lots of useful information in Silicon Valley Bank’s annual report. Even if you’re not in the wine industry it can make for a good read, revealing consumer trends applicable across various markets, and shedding light onto where macroeconomic indicators may head.

You can download the full “State of the Wine Industry Report” over on the SVB web site.