An interesting — and likely controversial — development in the world of Hi-Fi today.

Bose announced it has acquired iconic high-end audio manufacturer McIntosh.

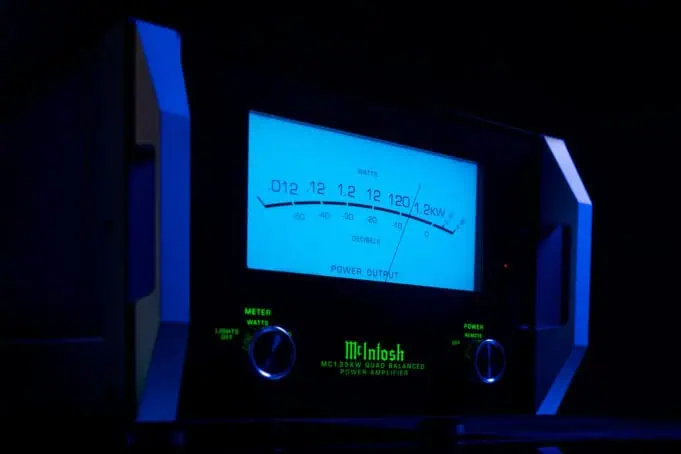

Even if you’re not an audiophile or follow the audio market closely you’ve probably come across the unmistakable blue and green branding that adorns pricey McIntosh components, which can easily run in the thousands of dollars each.

| Feature | Bose | McIntosh | Sonus Faber |

|---|---|---|---|

| Market Position | Mass-market consumer | Premium audiophile | Luxury artisan |

| Key Products | Noise-canceling headphones, smart speakers | Amplifiers, preamps, audio systems | High-end speakers |

| Brand Perception | Innovative but mainstream | Prestigious and niche | Elegant and exclusive |

The deal reportedly (CNBC) also includes Italian speaker maker Sonus Faber which is also aimed at the upper end of audio shoppers.

Since Bose is privately held ($3B revenue / 3,000 employees) we don’t know the size of the deal.

What Industry Leaders Are Saying

In an interview with CNBC, Bose CEO Lila Snyder emphasized the company’s focus on innovation in the high-performance and luxury space:

“We do think there’s a real opportunity around wearables in the luxury and high-performance space as well, which is something that we would expect you to see from us down the road.”

Meanwhile, reactions from audiophile communities are mixed. While some see this as a chance for McIntosh to expand its reach, others worry about potential compromises in quality.

What’s Next for the High-End Audio Market?

This acquisition reflects a broader trend in the audio industry, where premium brands are becoming prized assets amid increasing market consolidation. Recent developments include:

- Nikon’s Acquisition of RED Digital Cinema: Another example of a mass-market brand entering a niche, high-performance segment.

- Price Wars in Cinema Cameras: Competitive pricing strategies, such as RED’s Komodo-X price drop post-acquisition, could influence similar moves in the audio world.

It’s an interesting development to be sure. Die-hard audiophiles likely won’t be pleased with the association of Bose and McIntosh, the former seen more as a mass market consumer product vs. the latter’s niche and premium appeal. However, the alternative of a private equity deal might have been a worse outcome. At least with Bose, there’s a strong possibility the McIntosh brand is exposed to more distribution channels and marketing programs.

Strategic Implications

This acquisition could be a win-win—or a point of contention. Here are some of the opportunities and challenges:

Opportunities:

- Wider Distribution: Bose’s extensive retail and marketing networks could bring McIntosh and Sonus Faber to a broader audience, potentially boosting sales and brand awareness.

- R&D Synergies: Bose’s expertise in noise-canceling and wearables could merge with McIntosh’s and Sonus Faber’s strengths in audio fidelity, creating innovative luxury products.

- Premium Expansion: As the entry-level market is saturated with budget smart speakers (Amazon Echo, Google Home), this move aligns Bose with higher-margin luxury segments.

Challenges:

- Brand Dilution: Die-hard audiophiles may view the association with Bose as a step down for McIntosh, potentially alienating its loyal customer base.

- Cultural Fit: Integrating a mass-market giant with niche luxury brands will require careful management to maintain brand integrity.

Given that the entry level speaker and audio market has all but been devoured by personal assistant style products produced by Amazon (Echo and Alexa) and Google (Home) and Apple (Siri) that are typically priced well below $100 USD, it makes sense for the upscale producers to even further distance themselves in pursuit of juicy profit margins found in the upper tiers. There a speaker or component may be an object of lust — not pure functionality — and, in many ways, is likely closer to a fashion purchase than it is one of day-to-day practicality.

Time will tell where this leads.

In the meantime it’s pretty big news and should ultimately bode well, at least in the mid-term, for both companies.