Keurig has long been the dominant player in the capsule (pod) coffee market.

However, in 2022 and 2023 that appears to have changed. At least according to Google Trends.

Google Trends measures the number of searches for a particular word or combination of words over time. It’s a way of measuring interest in something, be it a car brand or model, a celebrity, stock, or even places to travel.

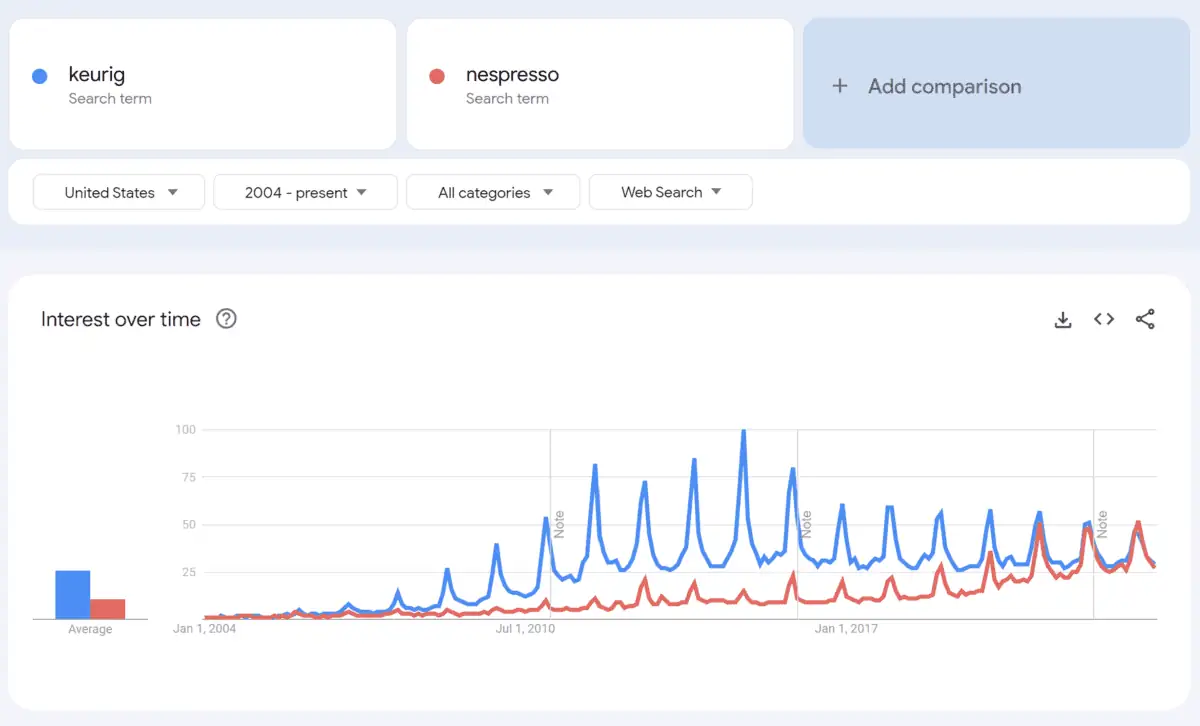

Comparing Nespresso (Switzerland) with Keurig (USA) shows an interesting trend over time in terms of Google searches for those respective brands. Here’s what the chart looks like from 2004 to present:

Google Trends: Keurig vs. Nespresso

Google Trends: Keurig vs. Nespresso

You can see in the above chart that interest in both Keurig and Nespresso exploded in the late 2000’s. People were searching for those terms, especially as you see in the consistent spikes, around Christmas time.

In the 2010’s Keurig had a clear lead. There’s significant separation between the blue line (Keurig) and the red one (Nespresso).

But in the last three years it appears that Nespresso has caught up to Keurig. That, as of today at least, about the same amount of people are searching for Keurig as they are for Nespresso.

What does that tell us?

Why is Nespresso Gaining on Keurig? (at least in terms of Google Search that is)

Why is Nespresso Gaining on Keurig? (at least in terms of Google Search that is)

It could be a few things:

- Nespresso is out-marketing Keurig, and therefore prospective buyers of those pod systems are inclined to search for both with about the same probability

- Nespresso customers are loyal, and spread the word by showing off their Nespresso machine to their friends and hence driving interest and demand, i.e. word of mouth

- Nespresso has a better product and user experience than Keurig

- Nespresso has increased its reach and distribution network and is available in more places (Amazon, Costco) and at varying price points that bring attention to prospective buyers who then Google to learn more

Of course, all of this is conjecture. It would require deep research and correlation analysis to determine the factors really driving this trend.

And it doesn’t necessarily translate into sales or market share shifts, though it would seem highly likely to be the case. After all, if people are searching for Keurig and Nespresso it’s probably because: (a) they’re researching pre-purchase; or (b) they’re learning how to use their new machine post-purchase.

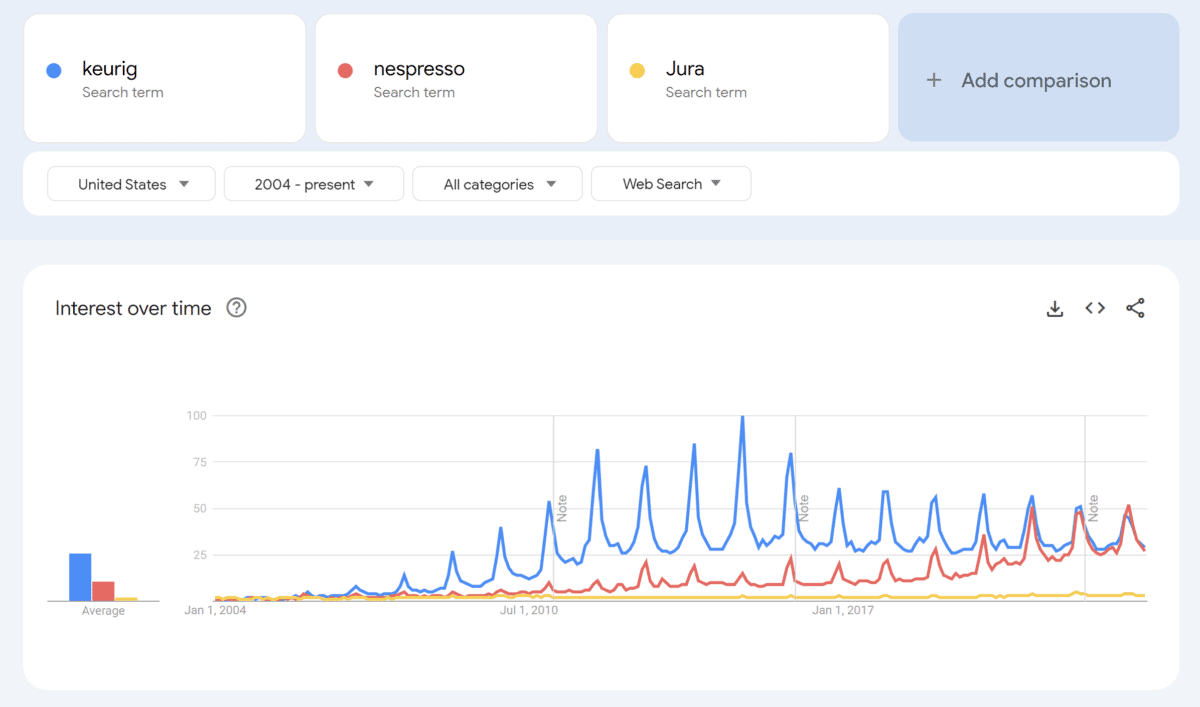

For fun I decided to then throw in the super-automatic (bean-to-cup) espresso machine market leader that is Jura. The Swiss company makes a line-up of relatively expensive machines that use coffee beans instead of pods. I was curious to see how Jura compared in terms of Google searches to Keurig and Nespresso:

Google Trends: Keurig vs. Nespresso vs. Jura

Google Trends: Keurig vs. Nespresso vs. Jura

Note: this one is just to compare markets and illustrate size differences. Prospective buyers would not likely cross-shop Keurig or Nespresso to Jura, as they are different market segments and price points.

Wow. Jura is represented by the yellow line. This appears to tell us there’s far more interest in pod-based systems like Keurig and Nespresso. Interest over time is smaller related to Jura Google searches than it is for the other two terms. And this, in my experience, is roughly accurate in terms of market size. Pod-based system markets are larger than bean-to-cup.

Meantime, standard drip filter coffee dominates them all with about 50% market share globally.

Meantime, standard drip filter coffee dominates them all with about 50% market share globally. Traditional semi-automatic machines (Gaggia, ECM, Rancilio, Profitec, Bezzera, Breville, Rocket Espresso, among other brands) are roughly on par with bean-to-cup super-automatic machines in terms of market share.

ALSO SEE: In Espresso: Jura Z10 super-automatic machine unboxing, first impressions, drink test

I should note that if you run the numbers for the super-automatic brands, Jura does in fact dominate. It’s a tricky comparison to get right, though, because several consumer brands such as DeLonghi, Breville, and Miele make more than just espresso machines, and offer a complete range of household products. That makes it hard to pinpoint interest in, say, Miele espresso machines specifically vs. those from Jura (who only sell espresso machines). You could get specific and enter a specific model, such as the Miele CM6360 and then try to match that up with the equivalent Jura model. However, given that model numbers and names change frequently this is harder than running the pod comparison of Keurig vs. Nespresso where both brand names represent the entirety of their overall target market.

So there you have it. Interest in time in Nespresso according to Google Trends (searches) has recently seen an increase, and now people are searching about equally for both “Keurig” and “Nespresso”.