When Clint and I were purchasing our primary residence, we subscribed to a credit monitoring company to make sure our credit scores were in good standing.

When Clint and I were purchasing our primary residence, we subscribed to a credit monitoring company to make sure our credit scores were in good standing.

As a rule though, based on the FCRA, the big three consumer reporting companies (Equifax, Experian and TransUnion) have to provide each individual a copy of their credit report upon request at least once every year or when you are denied for credit.

“Fair Credit Reporting Act (FCRA) requires each of the nationwide consumer reporting companies — Equifax, Experian, and TransUnion — to provide you with a free copy of your credit report, at your request, once every 12 months. The FCRA promotes the accuracy and privacy of information in the files of the nation’s consumer reporting companies. The Federal Trade Commission (FTC), the nation’s consumer protection agency, enforces the FCRA with respect to consumer reporting companies.”

source: Federal Trade Commission

You can order the reports from the FTC endorsed website: https://www.annualcreditreport.com/cra/index.jsp. However, I have always found it a pain the neck from a usability point of view and challenging to remember when was the last time I had requested a report. Finally, I do like to track my credit score at a greater frequency than yearly without paying what I think is a high subscription price for Equifax, Experian and TransUnion.

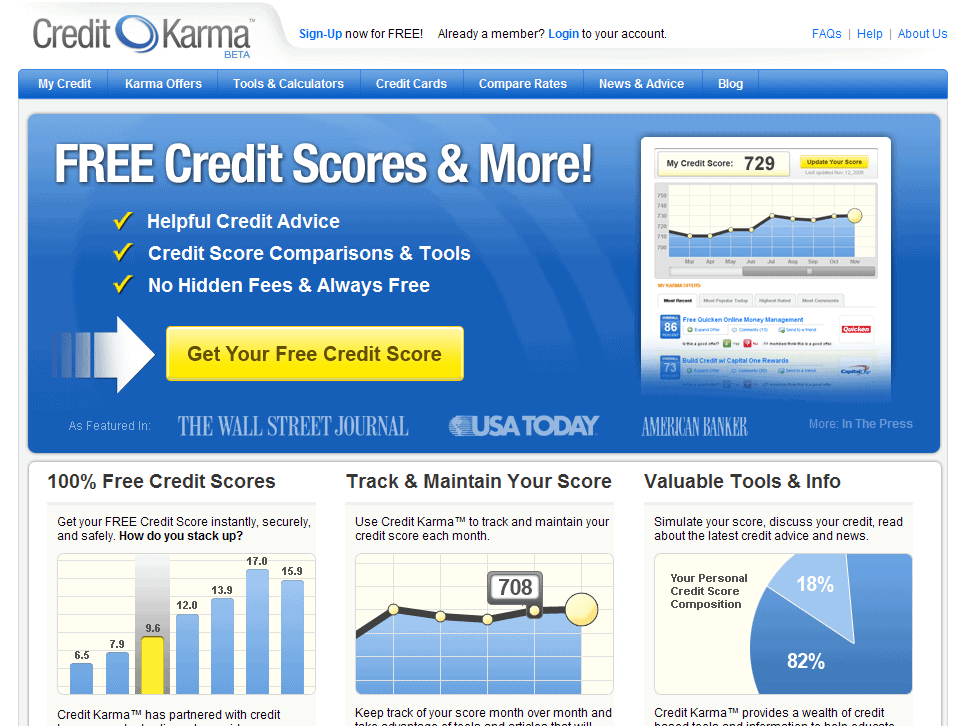

Enter CreditKarma.com, a company that after answering a couple of simple questions, gave me an approximation of my credit scores based on the major credit reporting companies. So it may be off by +/-50 points, but if you are just looking to make sure you are in generally good health, it’s exactly what the doctored ordered.

What’s nice about this service is that it is free and requires no credit card information. With a lot of other services, they offer a free trial period and then start charging you after the trial period. Credit Karma’s business model depends on making offers available to their install base from their advertisers. Not uncommon for many free services out there.

Besides just offering the credit scores, there are also tools to benchmark your score with others in various categories and run simulators to see what the impact of an action will have on your credit scores.

With the latest global financial crisis, it is important we all learn about the state of our financial health.